Malaysian tax planning represents the organized management of financial deals to optimize tax responsibility according to applicable legal regulations. The implementation of tax reliefs and deductions, and incentives in Malaysian tax regulations enables people and businesses to reach maximum tax advantages.

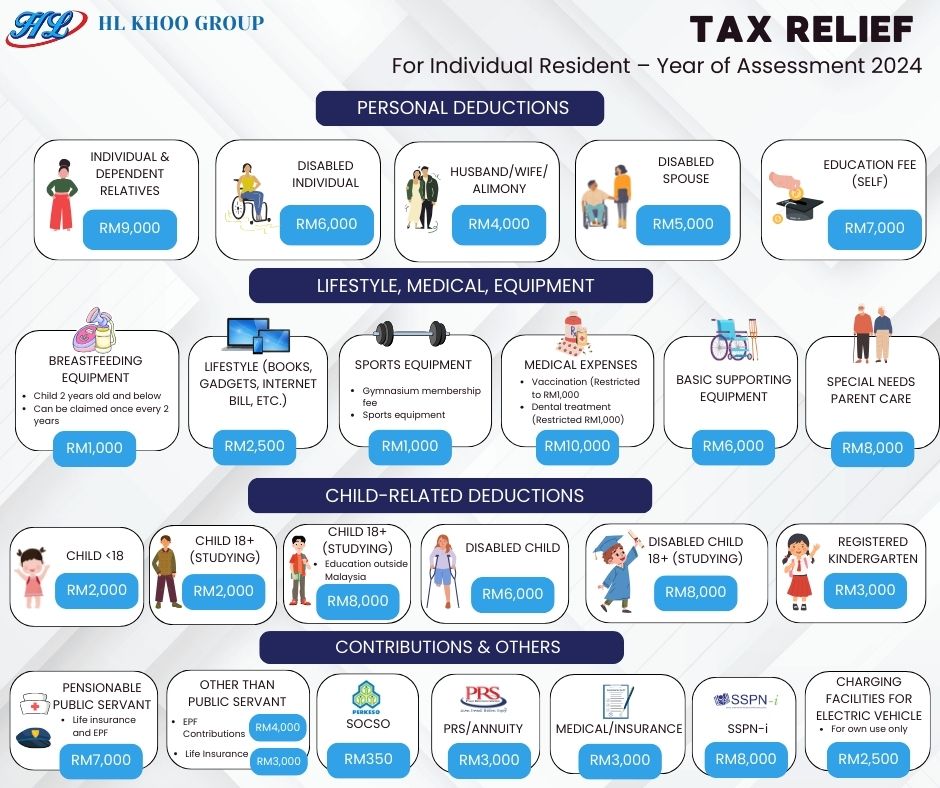

The Malaysian tax system allows taxpayers to claim different tax reliefs, which decrease their taxable amount and consequently minimize their tax liability. Key reliefs include:

People running business operations should select proper business frameworks to achieve optimal taxation positions.

Employees obtain at least two advantages from tax-exempt allowances and benefits-in-kind, as mentioned below:

The right arrangement of employee compensation packages produces noticeable tax reductions for organizations.

Malaysia provides different tax incentives that boost economic development, specifically for certain industries.

Businesses receive capital allowance benefits for eligible capital expenditures, which they can use to decrease their taxable income. The Reinvestment Allowance offers companies tax benefits through its 60% allowance on eligible capital expenditures when they carry out business expansion or modernization activities.

Group companies that share relationships can transfer a maximum of 70% of current year losses between associated businesses as part of group relief. The system permits members of corporate groups to optimize their tax strategies.

The Malaysian government implemented different tax reforms with effect from 2025.

Every business operating in Malaysia will be obligated to use e-invoicing systems starting July 1st, 2025. The digital tax system works through a platform created to enhance tax compliance while improving the tax administration process.

Businesses active in the Special Economic Zones of Malaysia receive supplementary tax breaks.

Businesses operate in the East Coast Economic Region (ECER) and Northern Corridor Economic Region (NCER) as well as Iskandar Malaysia through offering specialized incentives across manufacturing and tourism and agricultural, and Information and Communication Technology realms.

The Inland Revenue Board of Malaysia supplies the Dispute Resolution Proceedings (DRP) as an alternative mechanism to handle tax disputes effectively. After receiving a tax Notice of Assessment, the taxpayer must file Form Q to request a session with DRP. Both the taxpayer and IRBM can participate in DRP discussions to establish settlements before entering formal litigation. The dispute resolution procedure shortens both the financial expenses and the duration of tax disputes.

The appeal follows multiple steps, starting from when parties fail to settle, and concluding the DRP procedure.

Taxpayers have the option to request judicial review for uncommon situations when the IRBM makes decisions. The taxpayers can pursue this legal remedy to challenge power abuses or illegalities and procedural wrongdoings made by tax authority officials. Taxpayers who file judicial reviews have utility because all previous appeal options have been exhausted.

The DRP is an alternative mechanism provided by the Inland Revenue Board of Malaysia (LHDN) to resolve tax disputes efficiently. It allows taxpayers to engage in discussions with LHDN to reach an amicable settlement before proceeding to formal litigation.

To request a DRP session, submit a written request via letter or email to the Dispute Resolution Department after filing Form Q.

Form Q is the official notice of appeal against an assessment. It must be submitted within 30 days of receiving the Notice of Assessment.

If no settlement is achieved via DRP, the appeal progresses to the Special Commissioners of Income Tax (SCIT), and potentially to higher courts if necessary.

Yes, in exceptional circumstances, taxpayers may seek a judicial review if there's an alleged abuse of power, illegality, or procedural impropriety by LHDN.

Japan

Japan